The idea in brief:

- On 25 June 2021, the Western Australian Building and Construction Industry (Security of Payment) Act 2021 received royal assent.

- This Act was introduced to amend the State’s existing model under the Construction Contracts Act 2004 (WA) to align the model with the ‘East Coast’ Security of Payment model that has been implemented by every state and territory in Australia (except the Northern Territory).

- This has been instigated, amongst other things, by the consequences of the recent industry downturn in Western Australia (mainly as a result of reduced mining-related construction) which, as submitted by numerous industry participants, has led to increased competition and businesses working under lower profit margins. This in turn can lead to cash flow shortages which predominately impact the parties sitting lowest in the contractual ‘chain’.

- The changes will include:

- Introducing time limits for making payment claims.

- Requiring payment of payment claims to be made:

- For home building work, within 10 business days of receiving the payment claim; and

- For all other work, within 20 business days of receiving the payment claim for payments to a head contractor and 25 business days of receiving the payment claim for payments to a subcontractor.

- Introducing payment schedules, which must be provided within 15 business days of receiving the payment claim.

- Removing the requirement of a notice of dispute, which was previously required to be made within 14 days of receiving the payment claim if the claim was disputed.

- Allowing adjudicators, arbitrators and courts to declare ‘unfair’ notice-based time-bar clauses void.

- Introducing an offence for intimidating claimants, with fines up to $250,000.

- Requiring retention money to be paid into a Retention Money Trust Account.

- The changes under the Act are expected to commence on a date to be proclaimed.

The idea in detail:

In June 2021, the Western Australian Government passed the Building and Construction Industry (Security of Payment) Act 2021 (the Act).

The Act was introduced to amend the State’s existing model under the Construction Contracts Act 2004 (WA) to be more in line with the ‘East Coast’ Security of Payment model that has been implemented by every state and territory in Australia, with the exception of the Northern Territory.

The current security of payment system operational in Western Australia and the Northern Territory is procedurally different to the security of payment frameworks broadly adopted in all other states and territories of Australia – the so-called ‘West Coast’ model and the ‘East Coast’ model, respectively. While the ‘West Coast’ model provided an adjudication process that allows either party to a construction contract to adjudicate a contractual claim dispute, the ‘East Coast’ model provides avenues for recovery of payment arising from specific payment claims made for construction works under a construction contract (up the chain from contractor to principal only).

The Act was drafted following a review of the security of payment framework in the construction industry. This review titled Security of Payment Reform in WA Building and Construction Industry Final Report (the ‘Fiocco Report’) was commissioned in 2018 following a national review issued by John Murray AM (the ‘Murray Report’). The Murray Report largely preferred the ‘East Coast’-type models adopted in Queensland and New South Wales in coming to its recommendations for security of payment legislation frameworks Australia-wide.

The Fiocco Report identified a number of ongoing issues with the current regime which particularly affected small to medium sized businesses, but were persistent across Australia in the construction industry. In particular, the Fiocco Report identified the increased risk of payment delay or default as a result of the hierarchical contracting and the associated power imbalance between head contractors and subcontractors when negotiating contractual terms and risk allocations – with the end result being an imbalance of bargaining power that often results in deferrals of payment and other risks being principally borne by subcontractors least equipped commercially to manage them.

Similarly, and particularly relevant to Western Australia, the Fiocco Report explored the consequences of the recent industry downturn in Western Australia (mainly as a result of reduced mining-related construction) which, as submitted by numerous industry participants, has led to increased competition and businesses working under lower profit margins. This in turn can lead to cash flow shortages which predominately impact the parties sitting lowest in the contractual ‘chain’.

The recommendations of the Fiocco Report were largely aligned with the recommendations of the Murray Report – and recommended a substantive overhaul to the security of payment regime in Western Australia.

The McGowan Government originally tabled these changes in a bill in September 2020, however this then subsequently expired when Western Australia went to a state election in March 2021. The Bill was then reintroduced on 25 May 2021, and received royal assent on 25 June 2021.

What will the security of payment regime now look like in Western Australia?

The new Security of Payment changes in Western Australia will include:

- Time for payment of payment claims: Reducing the maximum period for payment of payment claims for work from 42 days to:

- 20 business days for payments to a head contractor and 25 days for payments to a subcontractor (unless the contract provides for an earlier date) for work other than home building work; or

- 10 business days or by the date provided in the contract for home building work.

- Unfair terms: Allowing adjudicators, arbitrators and courts to declare ‘unfair’ notice-based time-bar clauses void in some circumstances.

- Changes to excluded works: Removing ‘fabricating or assembling items of plant used for extracting or processing oil, natural gas or any derivative of natural gas, or any mineral bearing or other substance’ from work that is not ‘Construction Work’.

- Expiry Date for making payment claims: Introducing an expiry date for making payment claims. For claims other than a final payment claim, this will be the later of either:

- a date stated under the contract;

- 6 months from the works subject of the claim being completed; or

- 6 months from the service subject of the claim last being supplied.

- For a final payment claim, this will be the later of either:

- a date stated under the contract;

- 28 days after the end of the last defects liability period;

- 6 months from the works subject of the claim being completed; or

- 6 months from the service subject of the claim last being supplied.

- Timing and content requirements for payment schedules: Introducing payment schedules in line with the ‘East Coast’ model.

- These will need to be issued within 15 business days of receiving the payment claim (or a by an earlier date if agreed under the contract).

- The payment schedule will need to identify the amount of the payment (if any) the respondent proposes to pay, as well as reasons for their decision. The provision of reasons for the decision will be critical as they will be the only reasons the respondent can rely on if the issue proceeds to adjudication.

- If the respondent does not provide a payment schedule by the time provided, the respondent becomes liable to pay the full amount claimed by the due date for payment.

If the respondent fails to pay the payment claim amount or the amount stated in the payment schedule in full by the due date for payment, the claimant may either (but cannot do both):

- proceed to adjudication; or

- recover the unpaid amount as a debt in court.

The claimant can also proceed to adjudication is the amount stated in the payment schedule is less than the amount claimed in the payment claim or if no payment is proposed in the payment schedule.

- Adjudication application timing: The claimant may make an application for adjudication within:

- Where a payment schedule was received, 20 business days of either receiving the payment schedule or the due date for payment. The respondent will have 10 business days to provide a response but will only be able to include reasons that were included in the payment schedule.

- Where no payment schedule was received and the full amount has not been paid, the claimant must first give notice to the respondent of their intention to apply for adjudication within 20 business days of the due date for payment and the respondent has 5 business days from this notice to provide a payment schedule. The claimant must then make the adjudication application within 20 business days from the end of the 5 business day period above.

The adjudicator must make their decision within 10 business days of the adjudication response or due date for a response, or the adjudication application (where the respondent was not entitled to provide an adjudication response).

The adjudicator will decide the amount due, any applicable interest and the due date for payment.

A review adjudicator will be responsible for reviewing adjudication decisions, which must be applied for within 5 business days of the original decision being made.

Adjudication review applications cannot be made by the respondent unless the respondent has:

- paid any parts of the adjudicated amount that were undisputed;

- paid the part of the adjudicated amount that is in dispute into a trust account; and

- provided written notice to the claimant identifying the trust account the amount was paid into.

- Offence for intimidating claimant: It will be an offence for a person to threaten or intimidate a claimant in relation to the claimant’s entitlement to or claim for a progress payment or exercising any other right under the new laws to pursue payment, with fines of $50,000 for an individual and $250,000 for a body corporate.

- Retention Money Trust Account: Retention money held under eligible construction contracts must be held in a Retention Money Trust Account (previously it was only required to be held on trust where the contract did not specify how the money was to be held), with fines of $50,000 for an individual and $250,000 for a body corporate applying for a failure to comply with this requirement. Eligible construction contracts include constructions contracts to which the Act applies, but does not include:

- where the party for whom construction work is carried out (or relates goods and services are supplied) is a government party;

- where the value of the contract at any time does not exceed the prescribed retention money threshold (note: this amount has not yet been published but was noted in the explanatory memorandum to likely be $20,000 or less), or as otherwise prescribed by regulations;

- if the contract is for home building work for more than $500,000, unless the principal is a corporation, the work is for multiple dwellings or for the purpose of residential development business, or the contract is between a head contractor and a subcontractor; or

- if it is otherwise excluded by regulations.

These changes are expected to commence on a date to be proclaimed.

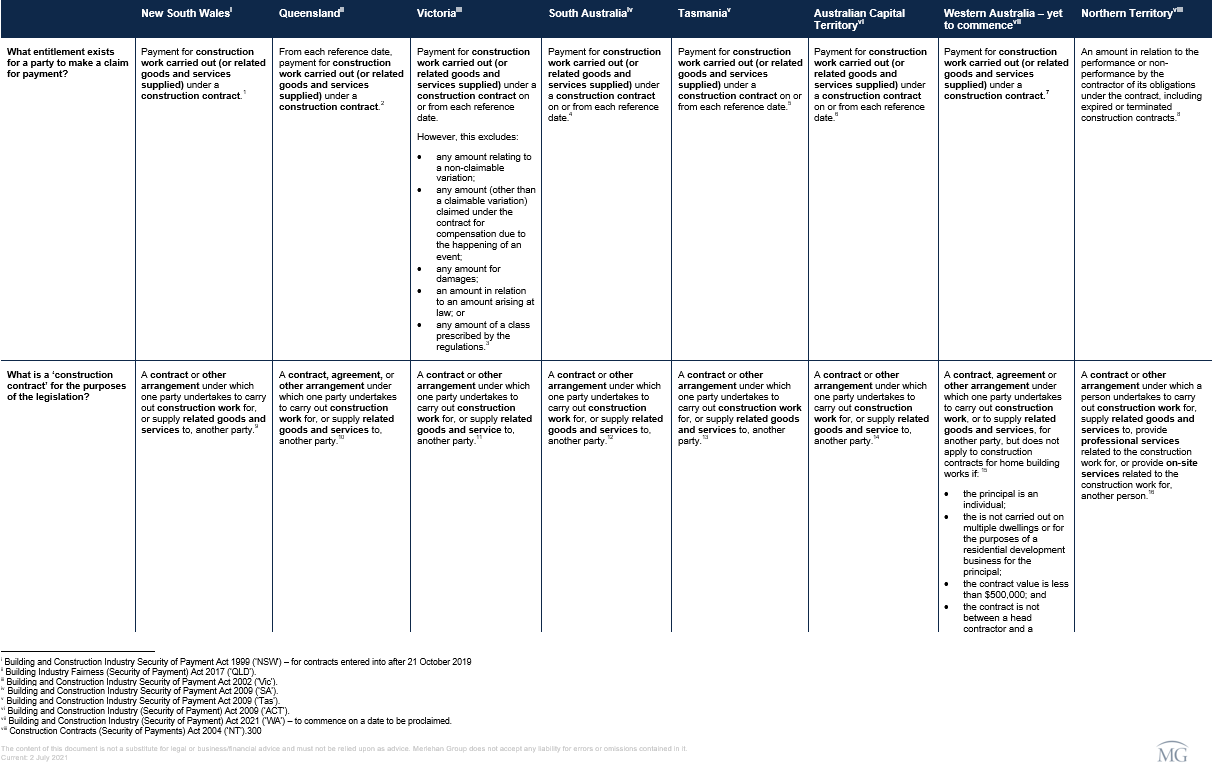

Our Australia-wide comparison table below has been updated to reflect these changes (on the assumption the amendments are eventually proclaimed and commence). You can download the table by clicking on the image below.

If you need assistance with pursuing or defending claims for payment under the various construction industry security of payment legislation in any State or Territory in Australia, email or contact Adam Merlehan adam.merlehan@merlehangroup.com (+6140219769) for more information.