The new Payment Times Reporting Act laws have largely taken industry by surprise, requiring new compliance processes to be implemented in most large businesses (>$100m) in Australia.

With the end of the first reporting period fast approaching, now is the time for all large businesses to ensure they are ready to prepare and submit reports under the Payment Times Reporting Act 2020 disclosing their payment performance metrics in paying small business suppliers.

In 2020, the Federal Government proposed and implemented new laws in the form of the Payment Times Reporting Act 2020, which will attempt to improve the payment practices of large businesses in Australia.

These new laws have so far proven to be more challenging than first expected to comply with for large businesses, due to the requirement to extract the necessary raw data from accounting systems, ensure the integrity of that data, and develop a new business process for reporting to be prepared for the new laws and signed off on by a director of the company.

We are currently working with large businesses, through our multi-disciplinary legal and finance/accounting expertise to assist large businesses develop and implement compliance programs that are tailored to each business and existing financial reporting systems. For more detail on the new laws, or for assistance with developing your compliance program, request a conference call to discuss.

In brief, what are the new laws and what do they require?

From 30 June 2021 large businesses will need to publicly report on their small business payment practices.

The Payment Times Reporting Act 2020 (Cth) requires all large businesses with annual turnover greater than $100m (including businesses in a corporate group which exceed that turnover), to submit a payment times report twice each reporting year, to a newly created payment times reporting regulator.

Since our last publication, the Federal Government has released the Payment Times Reporting Rules 2020, which implements additional reporting requirements that businesses will now need to prepare to report on.

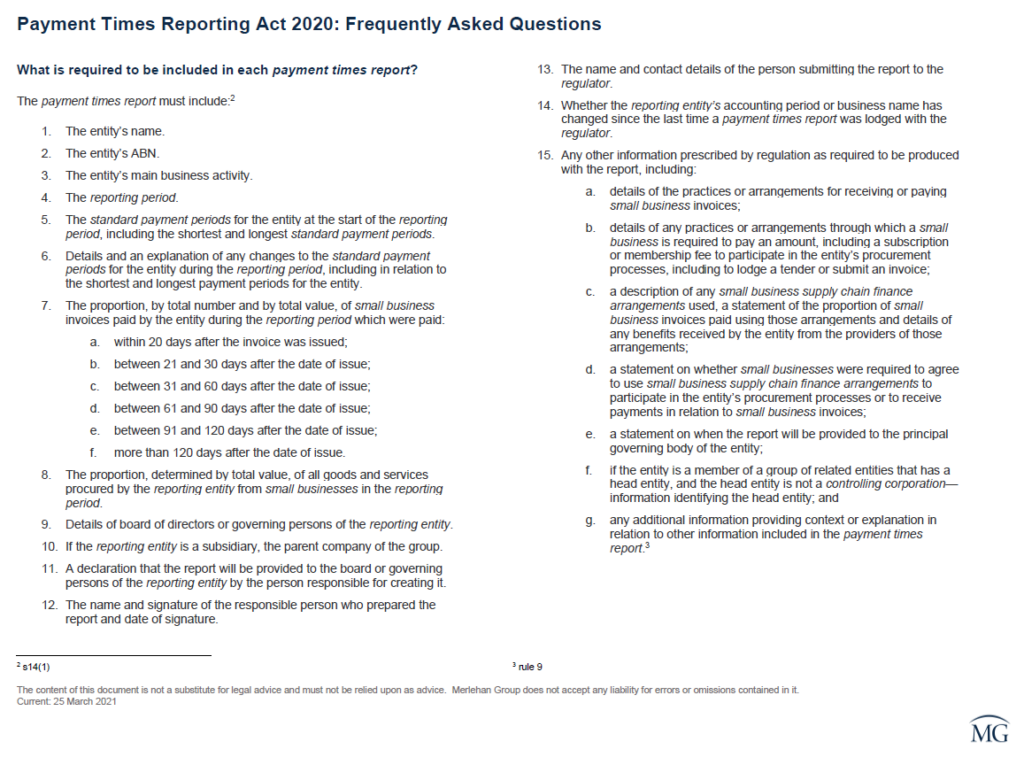

The payment times report will be in a standard form (not yet released) and be required to include specific information about the payment terms and practices of the submitting business and will include, amongst other requirements, reporting on:

- The standard payment periods for the entity at the start of the reporting period, including the shortest and longest standard payment periods.

- Details and an explanation of any changes to the standard payment periods for the entity during the reporting period, including in relation to the shortest and longest payment periods for the entity.

- The proportion, by total number and by total value, of small business invoices paid by the entity during the reporting period which were paid:

- within 20 days after the invoice was issued;

- between 21 and 30 days after the date of issue;

- between 31 and 60 days after the date of issue;

- between 61 and 90 days after the date of issue;

- between 91 and 120 days after the date of issue; and

- more than 120 days after the date of issue.

- The proportion, determined by total value, of all goods and services procured by the reporting entity from small businesses in the reporting period.

- Details of any subscription or membership fees charged to small businesses to allow them to submit a tender or an invoice.

- A description of any small business supply chain finance arrangements, including:

- the proportion of small businesses paid under the arrangements;

- details of any benefits received from providers of the arrangements; and

- details on requirements for small businesses to use small business supply chain finance agreements.

This information will then be uploaded onto an online free and publicly accessible payment times register.

Large businesses will be required to keep records of information used to prepare these payment times reports for at least 7 years after the report is submitted.

Why the new laws?

The laws are aimed at improving large business payment practices in Australia by exposing large businesses to greater public scrutiny and allowing small businesses access to reliable information on payment practices of their potential customers.

The theory behind the new laws is that long and late payment times adversely affect the cash flow of small businesses, leading to higher bankruptcy and exits rates, and small businesses lack the market power to correct this issue. The Federal Government has concluded that new laws are required to cultural change to payment practices of large Australian businesses, which will in turn deliver economic benefit to the Australian economy.

The payment times register will allow small businesses, members of the public, and press to freely interrogate the payment practices of large businesses and, in the case of small businesses, make better informed decisions about who to do business with.

The goal of the new laws is to see large businesses in Australia adopt more reasonable payment terms, of shorter duration, when paying small businesses.

The Federal Government estimates that the net benefit to small businesses from normalising small business payment times to 30 days would be $522 million per year, with an estimated net benefit to the Australian economy of $313 million per year.

Are there any penalties for not complying with the new laws?

Civil penalties and enforcement powers will apply to compel compliance by large businesses with these new laws.

The payment times reporting regulator may publish the identity of entities who fail to comply with the Act to publicise that misconduct.

Additionally, after a grace period of 12 months from commencement of these new laws, civil penalties of up to 0.6% of a large business’ annual turnover may apply to large businesses who fail to comply with these new laws.

The Regulator will also be given broad audit, monitoring and investigation powers under the Act including rights of entry, inspection, search and seizure of evidence to investigate and prosecute non-compliance with these new laws.

Where the payment times reporting regulator reasonably suspects that a reporting entity has breached these new laws, the payment times reporting regulator will also be able to force large business to engage, at the large business’ expense, an independent auditor to audit compliance with these laws and provide a report of the auditor’s findings to the regulator.

When do the new laws commence?

The commencement date for the new laws was 1 January 2021*.

*However, a reporting entity is only required to submit its first payment times report within 3 months from the end of that reporting entity’s first full reporting period that occurs after 1 January 2021.[1] For most businesses that are reporting entities, this means a payment times report must be lodged within 3 months of 30 June 2021.

Key takeaways – develop your compliance program now

Large businesses in Australia should begin preparing amendments to their corporate compliance programs and finance functions now in readiness to comply with these new laws.

Given the risk of substantial penalties under the new legislation, detailed work should be done to understand which entities in a company group may need to report, how the data necessary to prepare a payment times report can and will be extracted from the business’ accounting software and produced in the format required for each report, as well as correcting any data integrity issues that might arise from any existing data entry practices (that may now need modifying) before reports are routinely required to be prepared (minimising re-work).

We also recommend C-suite consideration be given to how current payment practices are likely to compare with industry and competitors when they are published on the new public register. This should be done to determine whether a reputational risk to the business’ brand could arise as a consequence of these new laws and the public scrutiny they will facilitate, and conversely, whether any opportunity can be seized by drawing upon data to be published on the payment times reporting register to highlight comparatively excellent payment practices, improving brand and reputation in the process.

Our support

We are currently supporting large businesses to implement compliance programs to comply with these new laws, through our multi-disciplinary legal and financial analytics/accounting expertise producing end to end solutions for clients. Our support includes ensuring the laws are understood by those tasked with complying with them, and that practical compliance programs (responsive to the each business software and reporting systems) are developed and implemented.

For support with complying with these new laws, contact our Adam Merlehan or Kylie Hawley to book a consultation.

Frequently asked questions

Some of the finer details of how these new laws will apply, and the questions they are likely to raise for businesses tasked with implementing them in the more than 3,000 large businesses affected by these new laws are addressed in Q&A format below (click below to download).

Further information on complying with these new laws can also be found here.

[1] s54A