The idea in brief:

- In 2019, as part of a long running prior-election promise to tackle reform to the building and construction industry, the Queensland Government commissioned two reviews:

- the Building Industry Fairness Reforms Evaluation and Implementation Panel, (the Panel Review) tasked with reviewing the effectiveness of security of payment laws in the building and construction industry; and

- the Special Joint Taskforce, which investigated complaints of fraudulent behaviour and subcontractor non-payment.

- These reviews reported to the Queensland Government in mid to late 2019, and provided many recommendations, some of them constituting major changes to building and construction industry laws.

- All of the recommendations were ultimately accepted entirely or in principle by the Queensland Government.

- The Queensland Government has now moved to implement the recommendations by tabling a Bill in parliament, the Building Industry Fairness (Security of Payment) and Other Legislation Amendment Bill 2020 (the BIF Amendment Bill).

- Two major reforms are undertaken:

- Major changes to Security of Payment laws (Security of Payment Reform); and

- Broadening of QBCC and other regulatory body powers to tighten regulation of industry participants including builders, engineers and architects (Regulatory Oversight Reform).

- This update deals with the Security of Payment Reform aspects of the proposed reform.

- Broadly they include:

- A new offence for any person given a payment claim to pay less than the amount stated in a payment schedule.

- A progressive roll out of Project Trust Accounts to most public and private sector projects above $1m.

- Mandatory use of retention monies trust accounts and trust account training as a precondition to being able to withhold retention monies from contractors and subcontractors.

- The ability for head contractors to impose a charge on the developer/principal’s land if an adjudicated amount it not paid; and

- The ability of head contractors and subcontractors to lodge a ‘payment withholding request’ one tier above its contractual counterparty if they are adjudicated an amount under a BIF Act adjudication but remain unpaid – requiring the superior party in the contractual chain (which in the case of a Principal/Developer, may be a project financier) to withhold that amount from payment due or becoming due to the respondent.

Our enclosed handout sets out the major changes, why they are relevant to your business and provides some commentary on their likely effect in the industry.

A further update will follow about the Regulatory Oversight Reforms which are also proposed in the BIF Amendment Bill.

It is important that all businesses in the construction sector in Queensland now review and evaluate their preparedness to respond to these proposed legislative changes and begin educating key staff and decision makers to understand the likely new laws and develop modified business processes to ensure compliance with them.

The Idea in detail:

There is no question that the construction industry has been a key focus of the Queensland Government since the last election.

With 2020 being an election year in Queensland, delivering on the previous election commitment to tackle reform in the sector has become a core priority for the Government.

This article is the first in a two-part series that will outline the key reforms the Government has now moved to legislate, and provide you with the key information you need to know to ensure that the changes in law are appropriately managed.

The proposed Security of Payment reforms

The Queensland Government’s signature legislation from the previous parliament, the Building Industry Fairness (Security of Payment) Act 2017 (‘the BIF Act’) had a built-in review process that required the appointment of a Building Industry fairness Reforms Evaluation and Implementation Panel (‘the Panel Review’) to evaluate the current operation and effectiveness of the recently implemented building and construction reforms.

This Panel met and produced a report included 20 recommendations for further legislative reform to the BIF Act.

Each recommendation was accepted or accepted in principle by the Queensland Government.

On 6 February 2020, the Queensland Government introduced the Building Industry Fairness (Security of Payment) and Other Legislation Amendment Bill 2020 (the BIF Amendment Bill) to implement these recommendations into law.

What do you need to know?

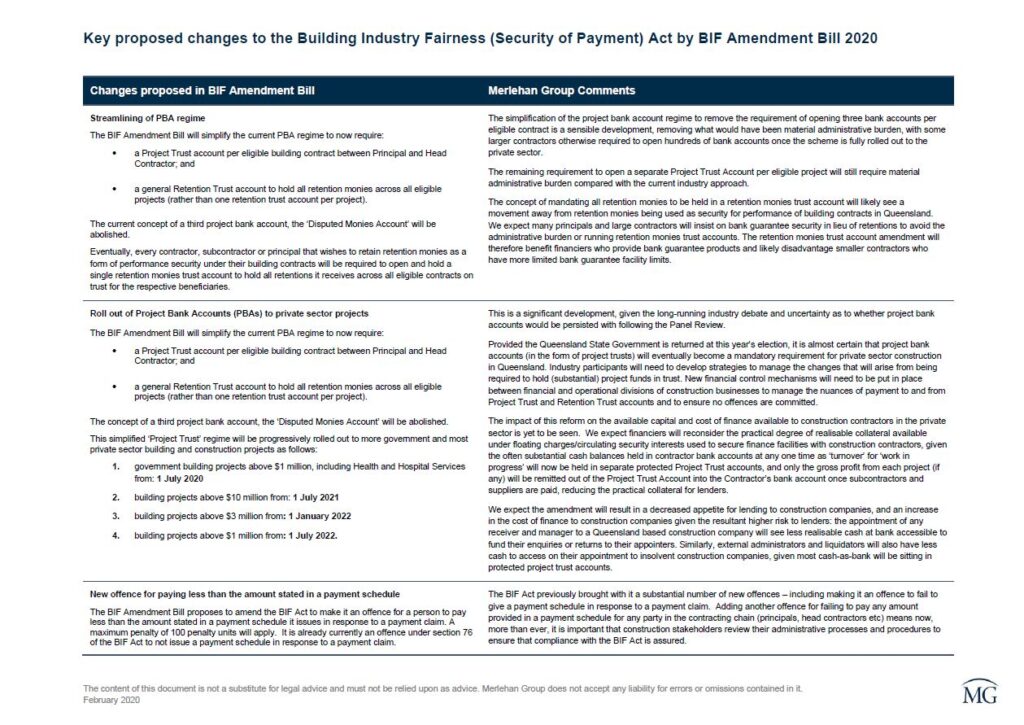

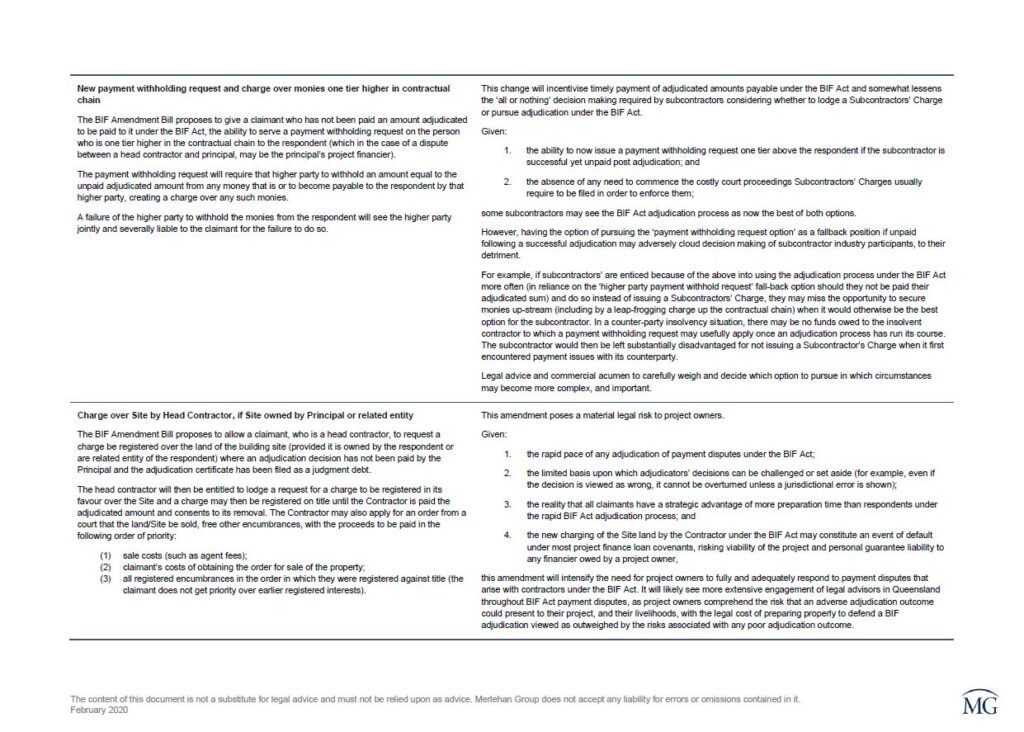

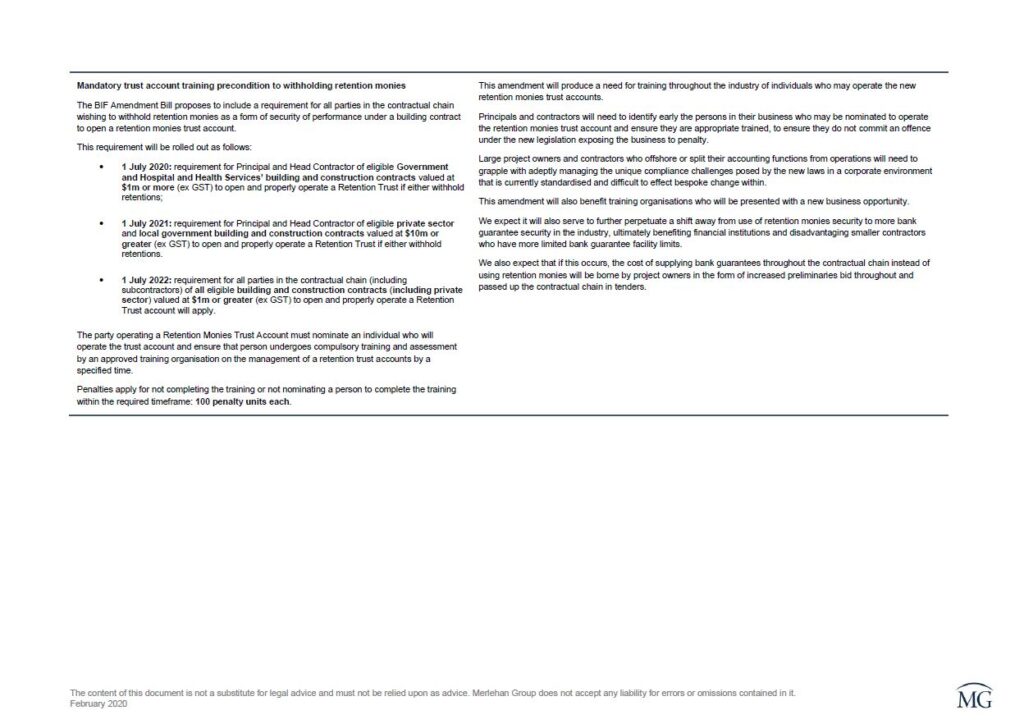

This handout summarises the key Security of Payment Reform changes (click image for PDF) forming part of the BIF Amendment Bill and our commentary about the impact each change is likely to have in the industry:

The amendment to these laws will require each business that is involved in the construction industry in Queensland to modify the way it does business.

We recommend you review the proposed laws, including the procedural requirements of operating or interfacing with Project Trust Accounts, Retention Monies Trust Accounts, dealing with or making payment withholding requests and the various changes to the BIF adjudication process proposed by these new laws, to ready your business for change.

When will these changes occur?

Some of the proposed changes will have an immediate impact on your business, others are proposed to be introduced progressively over the next couple of years. Some key dates are as follows:

- 1 July 2020: the new/simplified Project and Retention Trusts regime will replace the current Project Bank Accounts regime in operation for eligible Government and Hospital and Health Services’ building and construction contracts valued at $1m or more (ex GST). Provisions that allow contractors to impose a charge on the developer/principal’s land if an adjudicated amount is not paid will also commence. The requirement to open and properly operate a Retention Trust account will apply to Principals and Head Contractors of eligible projects who withhold retention monies but will not yet apply to lower level subcontractors who withhold retention monies.

- 1 July 2021: the Project and Retention Trusts regime will roll out to eligible private sector and local government building and construction contracts valued at $10m or greater (ex GST). The requirement to open and properly operate a Retention Trust account will apply to Principals and Head Contractors of eligible projects who withhold retention monies but will not yet apply to lower level subcontractors who withhold retention monies.

- 1 January 2022: the Project and Retention Trusts regime will roll out to all eligible private sector and local government building and construction contracts valued at $3m or greater (ex GST). TThe requirement to open and properly operate a Retention Trust account will apply to Principals and Head Contractors of eligible projects who withhold retention monies but will not yet apply to lower level subcontractors who withhold retention monies.

- 1 July 2022: the Project and Retention Trusts regime will roll out to all eligible building and construction contracts (including the private sector) valued at $1m or greater (ex GST). The requirement to open and properly operate a Retention Trust account will apply to all in the contractual chain of eligible projects who withhold retention monies, including subcontractors.

*eligible contracts include those that meet the above monetary and parties’ criteria and where more 50% of the work under the Contract is ‘project trust work’. ‘Project trust work’ is very broadly defined to include most building work. Exceptions for small scale residential construction and solely building maintenance or services contracts will exist but otherwise most building and civil contracts will be caught by the definition unless exempted by Government regulation in the future.

If you would benefit from assistance in understanding how these changes may impact your business, having your current contracts and business practices reviewed in light of these changes, or would like to have your staff trained in these developments, email or call Nathan Chalmers nathan.chalmers@merlehangroup.com (+61401641315)