Condev Construction, a major builder in the South-East Queensland market, has appointed liquidators, having failed to receive financial support requested from its developer clients to avoid the collapse of the business.

Condev’s liquidation follows national builder Probuild’s collapse only weeks earlier.

Much will be written about Probuild’s, and now Condev’s collapse. Some will suggest it is an example of a broken adversarial market forcing builders to participate in a zero-sum game for razor thin profits. Others will wave the concern away, describing Probuild and Condev’s predicament as outliers.

The truth though, lies in the numbers.

Besieged by a profitless boom

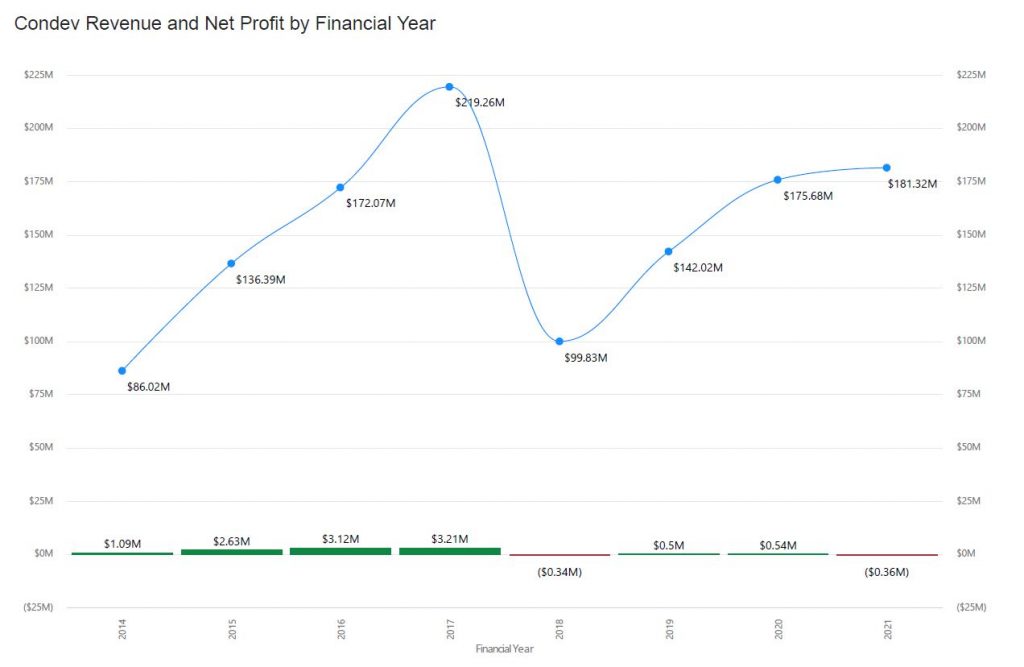

As a large proprietary company, Condev filed annual audited financial reports with corporate regulator, ASIC. This publicly accessible reporting tells the story. In the end, it is another sad tale growth business owners can empathise with: one involving top line revenue growth but with low conversion to bottom line profitability unable to sustain the business through the current unprecedented challenging market conditions.

Between FY2014 and FY2017, Condev experienced rapid revenue growth year on year, peaking at $219m in annual revenue in 2017. Net profitability after tax peaked at $3.2m, equating to a thin, but consecutively improving 1.46% net profit margin.

Then, things suddenly changed.

In FY2018, revenue halved to $99.8m, reportedly “a result of [Condev’s] smaller residential developer clients leaving the market in FY 2018”, with the business reporting a -$336,145 net loss.

By FY2019, a strategy pivot towards targeting large national developers saw revenue rapidly climb back to $142m, however net profitability was a mere $497,000, a wafer-thin net profit margin of 0.35%.

Then, COVID-19 struck.

In FY2020, revenue continued to grow to $175m, but conversion of that top line revenue to bottom line profitability continued to drift backwards, to a razor thin net profit margin of 0.31%.

By FY2021, revenue had further climbed to $181m, but the negative bottom line conversion trend continued, this time seeing the business report its second annual net loss over the eight year period of -$358,732.

A bad situation yes, but not a terminal one, particularly given most of the previously earned profits remained held as retained earnings in the business to achieve statutorily required net tangible assets/working capital requirements (all material commercial builders licensed in Queensland are required to maintain a net tangible asset level set by the Queensland Building and Construction Commission to maintain a commercial building licence. This NTA level is set relevant to annual turnover of the business).

The final straw though was the disaster that FY2022 has become for all large commercial builders.

But first, some context.

The commercial fallacy of a traditional business model in novel market conditions

Fixed price contracts that see builders adopt the risk of escalation in the cost of materials and downstream labour are common. Their prevalence is driven by developer clients pursuing perceived certainty to underpin the feasibility of their projects, to the comfort of their bankers.

Ordinarily, lump sum contracting is fine. Cost escalation is somewhat predictable in ‘typical’ market conditions by reference to leading and lagging indicators through the construction market cycle and macro economic indicators. Builders simply estimate their projects when tendering work to account for reasonably expected escalation in the cost of goods, materials and labour over the duration of the project, so to ensure the job is profitable.

The same situation applies with respect to the occurrence of inclement weather delays.

Weather has typically been predictable enough, at least to inform an acceptable risk adjusted price and plan for completing projects. Again, developer and principal clients prefer less risk and greater bankability of their projects by transferring cost or time risk (or both) associated with inclement weather to the builder. Builders are often willing to bid a ‘wet program’, including their own assessment of inclement weather allowance and accept inclement weather risk.

The builder then, despite assuming these risks, backs itself to manage and complete the work below its internal budget (and with limited defects) to produce acceptable levels of profitability. Realistically, this requires the builder to drive the performance of its subcontractors and suppliers on site, and adequately monitor quality and performance against plan, to ensure its budget and program assumptions are met.

Any unbudgeted bump along the way or the materialisation of a risk that was contractually assumed by the builder (but not adequately budgeted for in the tendered price for the job) erodes profitability of the project. With razor thin profit margins of less than 5% involved in some projects, it can quickly tip a profit making job into a loss making dilemma for a builder.

Why 2022 was the beginning of the end

FY2022 has produced an extraordinary set of circumstances which has thrown the above standard playbook into disarray for most major builders.

Supply chains are constrained globally as the world gets back on its feet following the heights of the COVID-19 pandemic and the construction industry is not immune to this phenomenon. Delays in sourcing glass and steel for construction projects has become a common problem, as has procuring bespoke off-shore engineered items.

In addition to the supply chain problems, inflation has now taken off in most foreign jurisdictions in the western world, adding fuel to the already upward price pressure caused by scarcity of supply due to the lingering supply chain congestion.

In the meantime, locally, the economy is flush with money as the Federal and State Government COVID-19 stimulus packages (including Job Keeper and the Federal Government Home Builder renovation and construction stimulus package) kept businesses afloat throughout the pandemic, and consumers buffered from the worst of the impacts from the pandemic. The current record low interest rates has fuelled speculation in property markets, driving construction activity and associated demand (and cost) for building materials to new highs, and this is not abating.

The above conditions translate to serious headwinds for the builders who agreed to lump sum pricing many months ago on now outdated assumptions when bidding projects that are only now entering execution.

If that were not enough, add to the equation the current La Nina` weather pattern and unprecedented levels of inclement weather experienced in South East Queensland year to date, as well as the effects of the failure of Probuild on subcontractor and supplier availability (causing increased supply costs as builders are required to procure materials from alternate suppliers at increased prices, and with potential delay).

The market conditions served up by FY22 make it almost certain that a builder bound to major lump sum contracts signed months ago on marginal terms to begin with, now finds itself in an untenable situation.

The outlook also is not optimistic.

Supply and materials cost increases do not look like abating quickly.

The latest anecdotal concerns in the industry surround rapid escalation in the cost of timber used in most construction projects due to the Russia/Ukraine conflict and international trade sanctions (Russia is currently the largest exporter of soft timber, globally). One only needs to look at the prices currently displayed on petrol bowsers around the country to see how rapidly macroeconomic disruptions flow through to the local economy, including the construction sector.

Unfortunately, large commercial builders sit at the bottom of the pile of all of these pressures, with most of these economic risks contractually transferred to them to manage by clients. The problem is that low (no) capacity exists for builders to manage these risks effectively in unique economic environments like the current one. They are beholden to market forces.

So while rapid revenue growth with low efficiency in converting that growth to the bottom line may have played a role in the lead up to the liquidation of Condev, it is not an uncommon problem for a major commercial builder successfully competing in a tough industry renowned for razor thin profit margins. The core driver of the downfall was rapid, severe and unexpected deterioration in market conditions – circumstances entirely outside the control of the business.

The solution

Debate could be had about what a healthy risk appetite and risk tolerance should look like for major builders in this new era:

- whether there remains a satisfactory level of predictability of weather events to enable builders to sensibly bear that risk as climate change is felt more severely locally;

- whether escalation in the cost of goods and materials and labour remains predictable enough to lump sum in the current market, or whether more rise and fall provisions to permit contract price adjustments (perhaps above a threshold of estimated escalation) should become more prevalent in standard form contracting;

- whether delay and cost increases caused by supply chain disruption needs to be better addressed contractually in standard form contracts where it can be shown that, through no fault of the builder, delays to materials supply by supply chain constraints have occurred.

Debate might also be had about how promptly the construction sector should move to recalibrate its behaviours to mutually share (and therefore reduce) the commercial risk assumed by contractors in periods of extreme uncertainty and volatility (like the current market). This could be done by:

- adopting the abovementioned rise and fall pricing mechanisms for key input pricing in contracts with upper and lower collars set within which no change in price is necessary but beyond which a repricing opportunity arises;

- adopting more collaborative contracting approaches and specific risk sharing for major execution risks in large projects, where a risk is best shared rather than transferred to a contractor with limited capacity to control or manage it; and

- developers/project owners engaging in a more hands on way up front to seek to understand each tenderer’s financial capacity and working capital requirements, assessing their current work book and competing pressures, and understanding through client-side led engagement during tender process exactly how each contractor has bid the job and developed its price by reference to known and possible project execution risks. Indeed, picking the median tenderer at the moment, rather than cheapest, may not be a bad decision.

Of course, it is easy in hindsight to analyse and offer suggestions. That is one of the core problems of expecting a market to correct itself in a highly competitive setting and to do so within time to achieve a recalibration without carnage. It is particularly so in a market with high levels of competitive rivalry, low bargaining power for suppliers, high bargaining power for buyers and a high threat of substitution from other suppliers. Those conditions are not conducive to timely market led change, and they are the conditions that currently persist.

Why the solution is not easy to implement

A commercial builder who decides to shift the dial ever so slightly to a more risk averse appetite when bidding jobs in a heated market can see its tender success ratio diminish rapidly and its market share decline. This is particularly so if others are willing to step in and assume that risk. It is also particularly the case if clients are not discerning or sophisticated enough to preference sensible risk adjusted pricing over lowest bottom dollar logic.

The reality though is, the same set of circumstances that have brought Condev and Probuild’s businesses to the point of liquidation are currently untenable for a large number of other major contractors. The only saving grace for other major contractors dealing with similar pressures, and what may be determinative to whether they can trade through current market conditions, will be whether:

- they have a larger amount of working capital to dip into so as to ride out unprofitable periods;

- they have managed to negotiate in their major works contracts rise and fall mechanisms to adjust pricing on account of the rapid materials cost escalation being experienced across the industry and inclement weather relief; and/or

- their developer/principal clients are willing (or shocked into by recent events) engaging openly to renegotiate (with the blessing of their financiers) the contractual risk allocations achieved in different market conditions to a more viable fair share of commercial risk in the current extraordinary market conditions. It can be done, but requires effort, high levels of stakeholder engagement and willingness to engage transparently on all sides to reset imperilled projects early.

At the moment, the harsh economic rationality of the free market is beginning to shake out those participants with low financial, operational and business model resilience in the prevailing market conditions. That is why extreme caution needs to be taken by regulators looking to impose new laws such as Mandatory Project Trust Accounts within the private sector at this time. It risks tipping the scales for contractors currently operating with a low level of business resilience in the current market conditions to a terminal level, creating more insolvencies and setting off a contagion effect within the sector.

Where to from here?

The consequence of the current insolvencies of Probuild and now Condev will produce a reckoning for not just the contracting side of the market but also client-side developers and project owners (and their bankers). Each need to adjust their expectations now in what is set to become a less competitive market place where only the fittest contractors will survive the longer the current market conditions and participant behaviours persist.

For developers and clients directly caught up in the collapse of major contractors, they too will feel immediate economic consequences. In our experience, projects impacted by the insolvency of the main contractor, almost without exception, end up significantly delayed and significantly over budget when finally completed. Often too, project owners find themselves caught up in the long tail of a lengthy liquidation process of the former main contractor. This not uncommonly involves significant legal expense.

In the end, there are no winners on either side of the market when major contractors of the scale and respectability of Probuild and Condev fold. On this sad occasion, it is no different.

We are currently supporting industry participants navigating these developments and current market conditions. Our thoughts are with all affected by these recent developments, including the founders, staff and families of these once very successful businesses.