When you next head to the airport for a business or leisure trip, don’t be lulled into believing that with somewhat spirited in-terminal pricing (like the below example from an unnamed Australian domestic airport), or the captive airlines waiting to park their 747s on the tarmac, must mean the CEO’s job of guiding the airport’s success is easy going.

It is pretty good now, but things will soon change.

Airports are only partly in the business of monetising landings and take-offs from their runways.

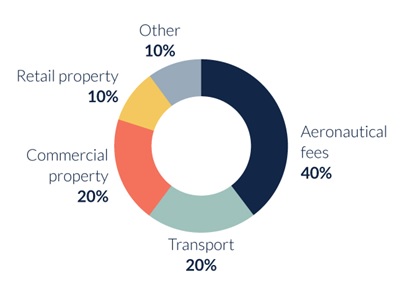

There are actually four dominant revenue streams for airports:

- Aeronautical fees (charges for take off and landing of planes at the airport or per passenger)

- Landside transport fees (money made from car parking and rental cars)

- Commercial/investment property (commercial property that the airport leases to others)

- Retail property (retail tenancies like food, fashion, and electronics, etc. in and adjacent to the airport terminal building)

Airports also make money from other sources, e.g. security charges, but the above four are the principal sources of revenue.

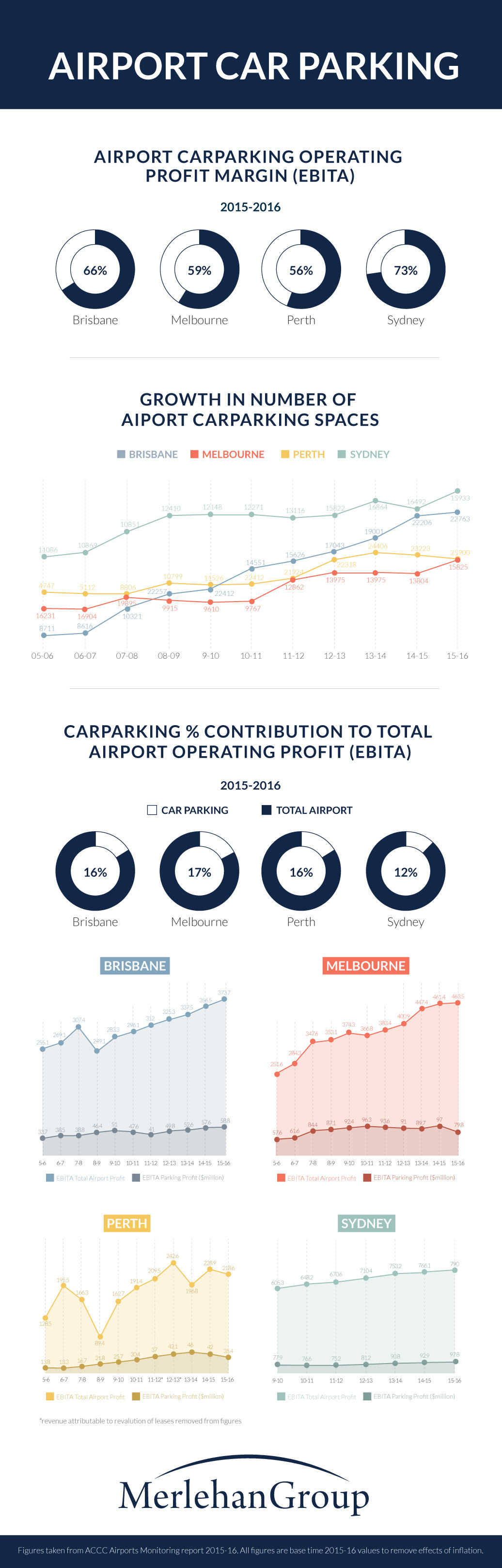

Of course, revenue is only half the picture. The profit made from each core activity is what matters most, and in the case of carparking, the operating profit margins our airports are yielding from that activity are extremely healthy, so much so, the ACCC, Australia’s competition watchdog, has been keeping a close eye on how much airports are charging for and profiting from airside parking annually.

But there is a threat looming for the current clover patch that is airport carparking profits.

General Motors in the USA announced that it expects to be mass producing autonomous cars, without steering wheels or pedals, by the end of 2019, with those cars deployed from 2019 as driver-less ride-hailing vehicles in numerous US cities.

And back at home, our Victorian government recently passed legislation enabling driverless cars to be trialled in Victoria without in-car human supervision and announced a grant programme to fund research for driver less cars.

So why does this present a threat to airports?

If we can soon enough own or hire a driverless car that will take us to the airport, and then park itself either back at home, or in a much cheaper ‘autonomous vehicle’ parking lot setup by a smart entrepreneur 5kms from the airport, the prospect of any of us being willing to pay $100.00 a weekend for that car to unnecessarily park itself just a few metres from the airport terminal is very low indeed.

As demand for adjacent airside parking diminishes, airports will be forced to back-fill car parking revenue which currently equates up to ~17% of each airport’s total operating profit, even greater if you include rental car operator lease costs, who will similarly shift their autonomous vehicle parking locations to lower cost off-site alternatives.

Airports will need to reimagine what they do with large slabs of prime land currently occupied by carparks. They will need to redraft their business model to backfill the consequent hole in profitability to meet continued demands of their institutional investor owners who demand profit growth, not stagnation and decline.

Creative use of the newly available land currently occupied by large tracts of carparking, introduction of flag fall passenger drop-off pricing for all users (similar to current ride-sharing and taxi schemes), greater surcharges on public transport (light rail and heavy rail) and, most importantly, monetisation of the airport “experience” will become the focus of gifted transformational leaders who will take over from the current crop of operational-leaders.

The alternative of trying to squeeze more cost out of an already optimised business won’t work.

What can airport management teams and owners do in response to this headwind?

First, not nothing, preparation for change in a rapidly evolving market is a necessity. Those asleep at the wheel (pun, and irony, intended) will be punished. Those that get ahead of the change and focus on consumer experience will be richly rewarded.

Second, start re-imagining now what it is they are actually in the business of selling and what it is they need to be in the business selling in the future in order to succeed. They will do this by asking themselves some simple existential questions: What business are we currently in? What business are we really in? What business do we need to be in 10,15 years from now, to not only survive, but thrive?

If the answer to the last question is, “We are going to need to be in the business of ‘enabling border-less commerce’”, that may translate into planning now to transition the airport precinct to a business precinct with world-class technological connectivity and other cutting-edge ancillary service offerings that businesses of the future are going need at their fingertips in order to succeed and obtain an advantage over their competitors (not the bog-standard business meeting rooms or co-working spaces, but a precinct where businesses will simply insist on being based corporately as opposed to CBD offices).

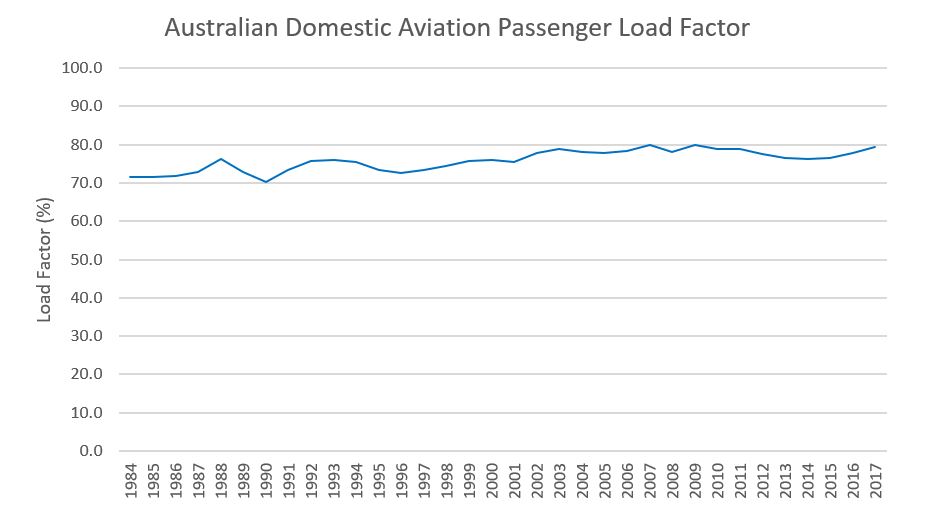

This line of thinking might result in investment now in research and development into speeding up the process of getting through airports to do business in-bound and out-bound (check-in, security, baggage handling) in a value co-creation exercise with airlines, or it might extend to a similar co-creation exercise facilitating a technology enabled location near-field Uber of air travel where passengers in the precinct can take up unsold tickets and no shows instantaneously at a fraction of the cost and then be seamlessly screened and whisked through a fast-track security by concierge to the aircraft gate. Presently 20% of the 77.28 million available seats on domestic airlines in Australia go unused each year. Airlines are most profitable when they have their planes in the skies as often and as full as is possible – so there is material alignment of interests in such an endeavour.

The possibilities are only constrained by what is imaginable and capable of being executed by the incumbent management team.

Or, if the answer is that the airport needs to be in the business of ‘providing the best start to the holiday “experience”’, they might focus on getting serious about truly entertaining customers and de-stressing the current airport “experience”. They might engage or partner with others who lead the world in customer entertainment/experience (for example, the world-class standard of customer service and entertainment at Disney), developing an airport precinct that people simply can’t wait to visit many hours before they fly off on holiday (and start spending their money), transforming the airport to a place that people “just so happen to be flying from” or may not be flying from at all but are attracted to visit and spend their hard-earned cash. The Uber of air travel concept could be extended to the recreational user, with those at the airport who have an ambivalence or perhaps thrill of the mystery about when or where they fly to next, able to capture no-shows and fill some of the 20% excess airline capacity mentioned above. Digital devices and location technology unlock potential in this regard, but only if the focus is on improving the consumer journey/experience.

For appropriately located airports, they might decide the airport is suitably located to become a ‘cultural, entertainment and visual arts hub for the community it serves under its social licence to operate’. That future airport precinct would look very different to any of the above. Think: auditoria, concert halls, exhibition centres, art galleries, green space, etc. Some airports are strategically located to make this work, others less so.

Or, is it something completely different to any of the above?

The point is, the thinking and internal debate is healthy to start now – autonomous vehicles are no longer a pipedream and transitioning the business operating model will take many years.

The most successful at this thinking process will begin mapping current consumer journey experiences when using airports. If they do this, they will find there is a huge opportunity for airports to offer and capture much more value throughout the customer journey experience by adjusting their own model and partnering with others in the ecosystem of value creation that airport users interact with before, during and after leaving the airport. They will appreciate the ‘journey’ starts well before the consumer sets foot in the airport and they will appreciate that with about 100 million passenger movements within, into and out of Australia annually, and an upward global trend for air travel, the opportunity of monetising the airport experience and the journey to and from it is a seriously large one that requires insight beyond the present short sighted charging for wifi, $9 bottles of water or $17 avocado on toast.

Third, forward thinking airports will start looking at their talent in the existing management team. Is it the right team to confront the challenges in the future? To develop a vision to transform the business and execute it well? What expertise will be necessary in different fields to achieve this business change? If there are talent gaps identified, they should plan to close them with disciplined succession planning and external recruitment or engagement of talent. The most forward thinking airports will rail against the current and historical trend of internal aviation industry appointments to senior roles and deliberately look to bring in business talent and leadership from other industries to offer fresh perspectives, ask new questions and challenge limiting beliefs.

Leaders with vision and a capacity to bring stakeholders with them on the business transformation journey are what will be needed to plan and execute the required strategy at just the right time, but not before it. Subject matter experts in fields of relevance for the new business model will be crucial and they will be foreign to the incumbent model.

Fourth, smart airport operators will start long-run planning of the strategic use of land around the precinct in the evolution towards the desired new operating model. Planning and evolution takes time and requires momentum. Airports are subject to federal regulation of development activity and land use, which requires high levels of stakeholder engagement and planning under the law and politics of doing airport business, including periodic release of 5- and 20-year development plans. The evolution of land use needs to be gradual, and a rolling sense of certainty and inertia created to effectively manage stakeholders in order to deliver the desired outcomes. Local, State and Federal Government as well as community groups will need to be brought along on the journey of change, not startled by it or forced into it.

Large scale internal business change programmes take on average five to seven years to achieve meaningful results. Adjusting an operating model and revamping a business culture that has been ingrained for so long is a big task that will require at least that time frame, so being proactive, not reactive will be key.

But, there is no cause for doom and gloom

Despite headwinds on the horizon, there is no cause for doom and gloom, only focused forward-thinking.

Airport owners are precisely the right type of shareholders to play the long game if convinced the leadership team has the right vision. The asset itself is not going anywhere. Airports are staples in a modern society. The owner class is a sophisticated one with deep pockets, capable of understanding and supporting long-term business transformation, particularly if that transformation is an accepted necessity for continued profitability and growth, and there is sufficient confidence in the leadership team to envision and then deliver on it.

So, will our airports someday include civic centres, cultural precincts, concert halls, attractions, shopping malls, green space, parkland, watercourses where the stroll to the plane is just the end of the first leg of an adventure? Will they be where you head to ‘work’ in a thriving, modern, technologically pioneering commercial precinct? Or will they offer something entirely different?

Only the capacity and vision of the leaders of airport organisations will determine these questions. However, in the current speed of industry change and possibilities, the reality is there is a sportscar with a manikin in it hurtling towards Mars right now as a pilot for a new business model. Very few of us are qualified to rule out what businesses of tomorrow will look like, and for this reason it is an exceptional time to be in business. Opportunity abounds for the visionary business leaders of tomorrow. Of course, there seems one thing that is likely to be off the table: the airside car parking super profits currently being counted by airport CFO’s around the country.

…

Our team at Merlehan Group consists of exceptional talent across business strategy, analytics, marketing, law, technology, change management and major project delivery, brought together in one firm, for one purpose: to see our clients succeed in business and outperform their competitors.