As most are already aware, the closing weeks of 2018 brought with them the commencement of a revised security of payment regime in Queensland in the form of the Building Industry Fairness (Security of Payment) Act 2017 (or, the BIF Act).

However, the impact of the revised regime has not been felt yet because the traditional Christmas shutdown period (22 December to 10 January, each year) which suspends time for processes/actions under the BIF Act followed shortly after the new laws commenced.

With that shutdown period coming to an end, the first round of payment claims under the BIF Act are just around the corner.

It is important to ensure that your business is properly prepared to manage the new and updated payment processes.

Practically, what do you need to do?

BIF Act checklist

It is important to note that the updates to the BIF Act apply to your existing construction contracts, so your existing contracts are not exempt.

Under the new BIF Act, every progress claim or written request for payment may constitute a payment claim under the BIF Act and should be treated as such by principals and head contractors – irrespective of whether they are marked as such.

So, if your existing processes rely on spotting a notation on an invoice or payment claim declaring that it is made under the legislation in order to trigger an internal assessment and legal response, that system needs to change immediately.

Here is a readiness checklist that will ensure that you are properly prepared to make and receive payment claims under the BIF Act:

- Have you trained all staff on the new process under the BIF Act? Training should cover: the fact that payment claims no longer need need to bear any special notation, new final dates for delivery of payment schedules, the consequences of failing to provide payment schedules (i.e. a respondent to a payment claim will be liable to pay the entire amount claimed, with no ‘second chance’ response or ability to provide adjudication responses or defend any court proceedings bought) and the various new offences under the BIF Act and QBCC Act that could result in fines or imprisonment because of improper contract administration;

- Have you reviewed your existing contract administration processes to to build in triggers and points of escalation to ensure contested payment claims are identified and responded to internally promptly, with appropriate resources?

- Have you reviewed your existing accounts payable processes to build in exceptions to any lengthy payment processes your business adopts which may be inconsistent with BIF and the QBCC Act, so as to ensure compliance with payment timeframes?

- Have you amended your existing contract suites to refer to the new legislation, provide compliant payment process and timeframes and take up the longest possible assessment timeframes for payment claims under the BIF?

- Have you developed an internal procedure for resourcing and responding to disputed, material payment claims with internal and external assistance as required?

- Do you ensure your registered office address (as notified to ASIC) is regularly checked for receipt of payment claims?(claimants are entitled to serve payment claims at this address, not just the address for receipt of claims noted in your construction contracts)

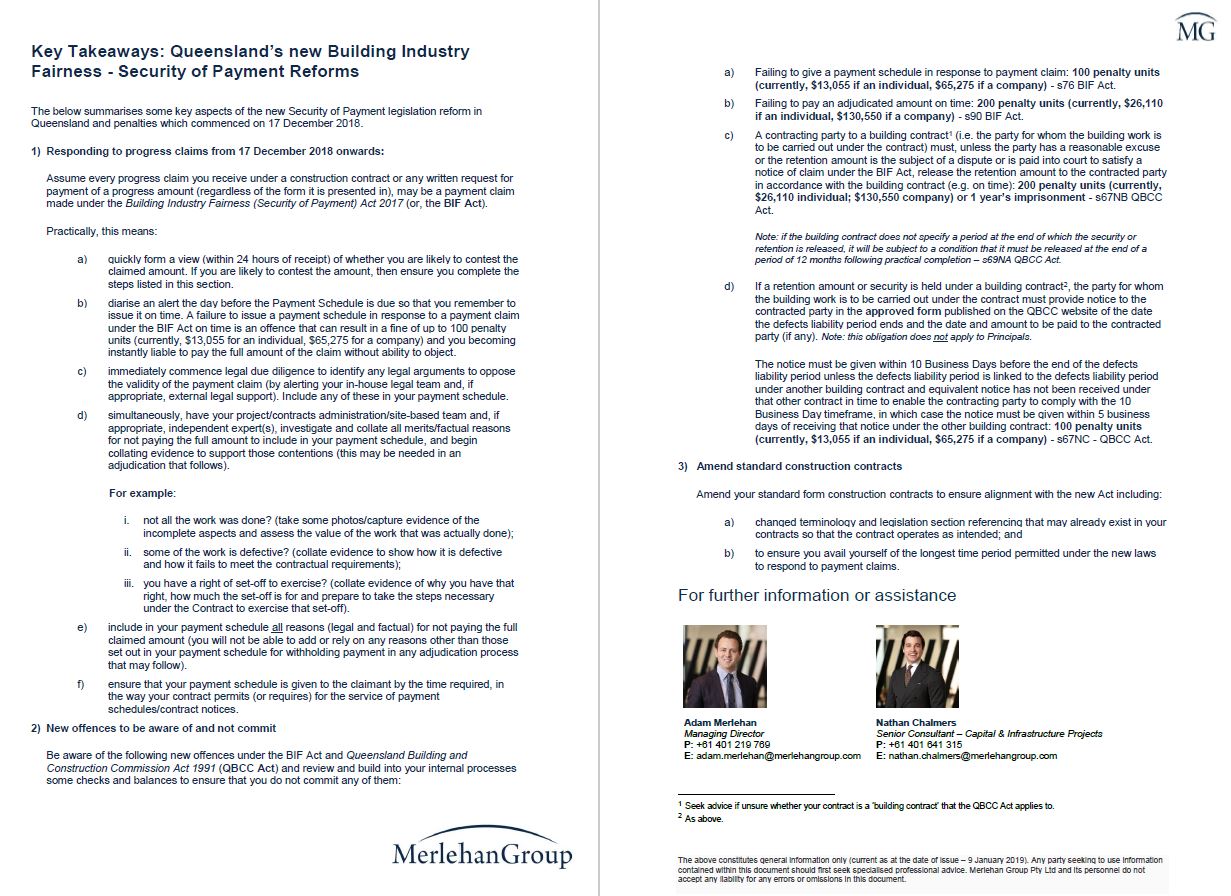

We have prepared a handout that can be provided to your internal contract administration teams to ensure that they are across the key details of the new legislation (click for PDF).

If you would benefit from assistance to review your current contracts, train your staff or review of your business processes to ensure pragmatic compliance measures are in place, email or call Nathan Chalmers nathan.chalmers@merlehangroup.com (+61401641315)